New Report Finds Federal Tax Bill Deepens the Feminization of Poverty

Report released by The Women’s Foundation of Colorado, with analysis from the Colorado Fiscal Institute, urges leaders to center women in economic decision-making

A new report released today by The Women’s Foundation of Colorado (WFCO), with analysis provided by the Colorado Fiscal Institute (CFI), reveals how the federal tax and spending package known as H.R. 1, or the “One Big Beautiful Bill Act” (OBBBA), will worsen existing inequities for women and families across the state. The report, Deepening the Divide: H.R. 1 and the Feminization of Poverty, authored by Shana McClain, research manager at CFI, and Chris Stiffler, senior economist at CFI, shows that changes in tax credits, health coverage, and education funding created by H.R. 1 will deepen the economic divide for women in Colorado—particularly single mothers, women of color, and immigrant women.

“When women do better, we all do better,” said Renee Ferrufino, president & CEO of The Women’s Foundation of Colorado. “Women are the backbone of families, communities, and our economy. But policies like this federal tax bill weaken the programs that help women thrive, such as affordable health care, quality education, and fair tax credits. When women’s stability is undermined, the entire economy becomes shakier.”

Federal tax bill is a direct hit to women’s health, income, and economic mobility

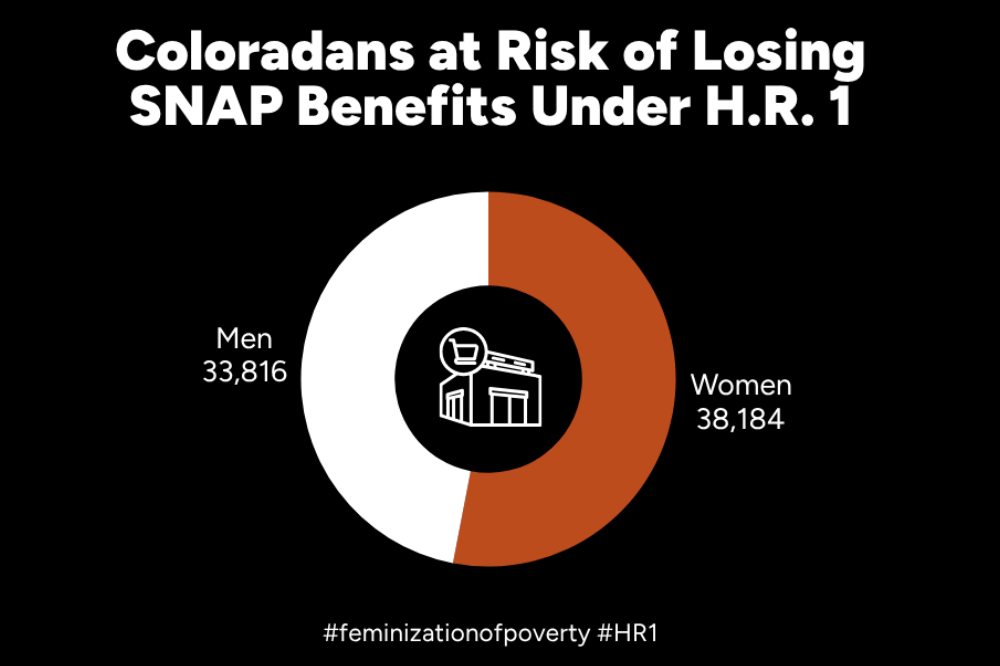

The report highlights that women hold nearly two-thirds of student loan debt, yet H.R. 1’s tighter borrowing limits and loss of deferment options make repayment more difficult. New work requirements in Medicaid and the Supplemental Nutrition Assistance Program (SNAP) will strip benefits from tens of thousands of Colorado women, particularly single mothers of teens. Federal tax cuts for high-income earners will eliminate key state tax credits that working families depend on, including the Family Affordability Tax Credit (FATC). “These are not abstract policy shifts, they are direct hits to women’s health, income, and economic mobility,” said McClain. “H.R. 1 rewards wealth over work, and in doing so, it deepens the feminization of poverty.”

The report highlights that women hold nearly two-thirds of student loan debt, yet H.R. 1’s tighter borrowing limits and loss of deferment options make repayment more difficult. New work requirements in Medicaid and the Supplemental Nutrition Assistance Program (SNAP) will strip benefits from tens of thousands of Colorado women, particularly single mothers of teens. Federal tax cuts for high-income earners will eliminate key state tax credits that working families depend on, including the Family Affordability Tax Credit (FATC). “These are not abstract policy shifts, they are direct hits to women’s health, income, and economic mobility,” said McClain. “H.R. 1 rewards wealth over work, and in doing so, it deepens the feminization of poverty.”

The report calls for a statewide commitment to confronting “the gap between our words and our actions” when it comes to gender equity. “Progress has been made, but far too modestly,” said Ferrufino. “Gender representation alone isn’t enough—what we must achieve is true gender equity. It’s not for the powerful few but for the benefit of all of us. Equity strengthens families, communities, and businesses alike.”

Organizations and government must weave a gender perspective into policymaking

“True equity requires systemic change,” added Ferrufino. “Organizations and governments must weave a gender perspective into every strand of policymaking. And that can only happen through the meaningful participation of women and girls themselves.”

“Organizations and governments must weave a gender perspective into every strand of policymaking. And that can only happen through the meaningful participation of women and girls themselves.”

Support ballot measures to protect programs like Healthy School Means for All and SNAP

While the report details sobering findings about the federal tax bill, it also outlines actions every Coloradan can take to close the gender gap and strengthen the state’s economy. “There’s something every Coloradan can do right now,” said Ferrufino. “By supporting ballot measures that protect programs like Healthy School Meals for All and SNAP, voters can help offset some of the harm this federal law will cause, and send a powerful message that Colorado invests in women and families.”

“We also need policymakers to prioritize investments that protect women and families when they make tough budget decisions,” said Stiffler. “And we need the business community to see gender equity as a business imperative. A well-supported, healthy workforce is good for the bottom line.”

Both organizations emphasize that the report is nonpartisan and grounded in data, but its findings underscore an economic truth: when women thrive, Colorado thrives. Deepening the Divide: H.R. 1 and the Feminization of Poverty analyzes how provisions of the federal tax law reshape access to health care, education, and income support through a gender lens. Using U.S. Census and state fiscal data, the report quantifies the real impacts of H.R. 1 on Colorado women and families.

Read the entire report or executive summary.