Understanding Colorado’s “T-Word”

Colorado Fiscal Institute Helped Me Understand TABOR So I Can Advocate for Better Policy

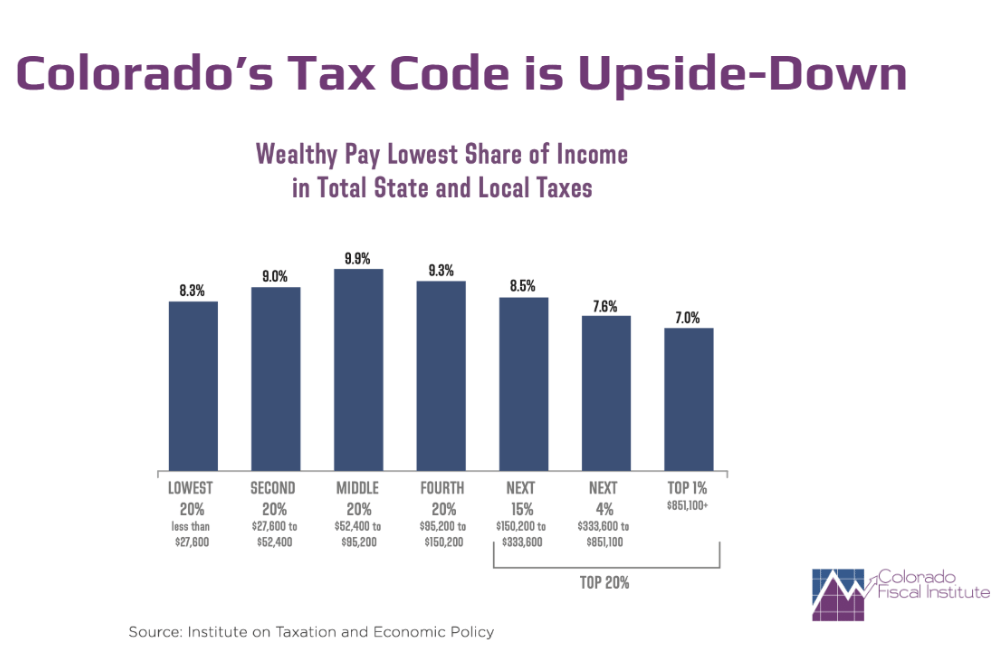

I completed the Tax Ambassador program to learn about Colorado’s “upside-down” tax system

1992 was a year that changed Colorado’s history in vastly positive and negative ways. Our physical landscape evolved and our economy grew with the opening of Denver International Airport, Coors Field, and the last stretch of I-70 in Glenwood Canyon. In contrast, our policy landscape regressed when voters passed two detrimental statewide ballot measures that limited opportunity and economic prosperity for all Coloradans.

The first was Amendment 2, which made it illegal to prohibit discrimination based on sexual orientation and gave Colorado the unfortunate nickname the “hate state.” Thankfully, the law never went into effect and was overturned by the Supreme Court in 1996. However, Colorado voters also passed in 1992 the Taxpayers Bill of Rights (TABOR) Amendment that continues to hurt our state more than 30 years later. TABOR, or colloquially the “T-word,” severely limits investments in public services that propel our economy and maintain our quality of life. Schools, teacher salaries, infrastructure, health care services, child care and early education, parks, libraries, fire departments, and police services are just some of those services.

TABOR is the most restrictive tax and revenue limitation in the country

I was shocked to learn that TABOR is the most restrictive tax and revenue limitation in the country, and it applies not just to the state, but to all levels of government here unless the government takes a voter approved step called “de-brucing.” In almost all discussions around policy that I’ve been privy to, TABOR is the behemoth obstructing our state’s progress.

As the vice president of communications for the Women’s Foundation of Colorado (WFCO), which engages in public policy advocacy to create equitable economic opportunity for Colorado women and families, I need a strong understanding of TABOR and how it impacts the types of policies for which we advocate. Furthermore, I need a better understanding so I can fill out my ballot more knowledgeably.

For help, I turned to Colorado Fiscal Institute (CFI), a long-time public policy grantee partner of WFCO that addresses how tax, budget, and economic policies can create widespread prosperity. CFI is a force at the Capitol, advocating for bills such as the Family Affordability Tax Credit (FATC), the Care Worker Credit (CWC), and the Earned Income Tax Credit (EITC). It also facilitates public education through its tax ambassador program to help Coloradans understand how our tax system works, including TABOR, so they can more effectively advocate for people-centered economic and fiscal policies in Colorado.

“We are educating people about what they’re voting on and creating informed decision makers,” said Caroline Nutter, CFI’s legislative coordinator. “We’ve found when it comes to fiscal issues, many people won’t even vote on them because they are confusing. But tax and fiscal policy touches the roads we drive on, our air quality, our kids’ schools. It affects everything you see when you leave your house — our sidewalks, parks, and recycling.”

…tax and fiscal policy touches the roads we drive on, our air quality, our kids’ schools. It affects everything you see when you leave your house — our sidewalks, parks, and recycling. – Caroline Nutter

I registered for CFI’s Tax Ambassador program to understand how TABOR impacts us all

In 2025, it’s especially important for Coloradans to understand the fiscal issues because Colorado is facing a $750 million budget shortfall in our state budget, largely because of TABOR’s restrictions. It’s been said that 2025 will be “the year of the budget cut at the State Capitol.” Compounding the $750 million deficit is the expiration of the federal Tax Cuts and Jobs Act (TCJA) at the end of this year. If the TCJA is to be continued with its promised tax cuts for the wealthy and corporations, Colorado will see a sharp decrease in federal funds. This will worsen the shortfall because our state is not able to backfill any loss of federal investment in our state due to TABOR.

Knowing how complex all of this is, I registered for CFI’s fall 2024 Tax Ambassador program, made up of six learning modules taught over Zoom by its knowledgeable staff. For those who have just a basic understanding about TABOR, like I did, it was a great space to gain a better understanding of what its provisions actually mean and how they impact our everyday lives, such as:

- Voter approval for tax increases: Any new tax or new debt, tax or debt increase, or tax policy change that results in net new revenue must be approved by voters. While this ensures public input, it makes it extremely challenging to respond to urgent community needs like infrastructure repairs, affordable housing, emergency services, or changes in federal support.

- Capped revenue: TABOR sets a limit on the amount of revenue the state government can collect and spend in any fiscal year, also known as the TABOR cap. Even if the economy grows and tax revenue increases, the government cannot automatically use the extra funds because TABOR limits spending to the previous year’s amount, adjusted for inflation and population growth. The state must return revenue in excess of the cap. In the 30-plus years since TABOR was enacted, Colorado has returned money to taxpayers 11 times, including $3.68 billion in 2023. To put this number in context, if average teacher salaries are $50,000, that rebate money could have paid for the annual salaries of 74,000 teachers or provided Medicaid coverage for 370,000 people with low incomes. Additionally, when TABOR was introduced in 1992, no one could have predicted how our schools’ needs would increase, now requiring school resource officers (SROs) and more mental health services, for example. TABOR simply isn’t built to meet our community’s needs in 2025.

- Limits tax options: TABOR specifically prohibits certain kinds of taxes, including a graduated income tax and a statewide property tax or new or increased real estate transfer taxes. By having a single-rate income tax of 4.4% instead of a graduated income tax, it results in an upside-down, or regressive tax system, in which those with the lowest incomes pay the highest shares. For instance, those earning over $100,000 earned 43% of the income in the state in 2020 but only paid 36.7% of taxes. This upside-down system disadvantages Black women and Latinas because they are over-represented in lower-income groups.

Because of TABOR, we must use other tools to help Coloradans facing the steepest economic barriers

There are other limiting provisions in addition to these three main ones. Voters have ended some of them, but the most obstructive features of TABOR remain. This means that WFCO and our public policy partners, including CFI, must deploy other tools, such as tax credits, to even the playing field for Coloradans facing the steepest economic barriers.

“Tax credits have delivered millions of dollars to families and have been a really powerful way to redistribute economic power,” said Nutter. “Tax credits are incredibly impactful because they are direct cash to people, they have no caveats, and no requirements of where you have to spend the money. Through that autonomy there is a really big return on investment. Parents know best.”

She cited examples of families using the child tax credit on groceries, school clothes, tutoring and extracurriculars for their kids, and child care so they can go from being part-time employees to full-time employees. WFCO knows from our WINcome grantmaking strategy that this is true.

Colorado Fiscal Institute also advocates for workers’ rights, environmental justice, affordable housing, and more

CFI also advocates for workers’ rights, environmental justice, affordable housing, and broadly shared prosperity among Coloradans – regardless of their immigration status – as part of its focus to make sure the economy works for everyone, not just corporations or the wealthy. In 2025, CFI is supporting a bill that would rewrite the Labor Peace Act, making it easier for unions to require that all company employees pay fees for collective bargaining representation, regardless of whether they are members of the union. They also support the Worker Protection Act, a bill that would make it easier for unions to organize, and a bill that would enforce workers’ rights pertaining to wage and hour laws.

In the fiscal space, CFI plans to introduce TABOR reform legislation that would strike the language that mandates a flat income tax and proposes a graduated income tax. This kind of change to TABOR could result in a fairer tax code, and depending on how a graduated tax system is designed, could bring in more revenue from higher earners that would mitigate against our state’s budget shortfall or catastrophic federal cuts.

All of the bills are supported by The Women’s Foundation.

Become a tax ambassador with me to help advocate for a fairer tax code in Colorado

TABOR is only going to continue to wreak havoc on the future of our state and helping women and families thrive unless legislators and voters can make changes. To help CFI and WFCO advocate for more equitable tax policies, including TABOR reform to allow for greater investments in our state and a more fair tax code, I encourage you to check out the following opportunities:

- On Feb. 25, attend CFI’s webinar “The High Stakes Budget: Federal Risks and Their Impact on Colorado” with Colorado Consumer Health Initiative

- On March 12, attend WFCO Advocacy Day at the Capitol

- Sign up for CFI action alerts

- Register for the Tax Ambassador program, beginning Feb. 27, 2025

- Order the Purple Book

- Listen to CPR’s fascinating three-part podcast The Taxman

Other tax resources

- Free income tax preparation for those who qualify

- Get an estimate of the tax credits you may be eligible for in English and Spanish