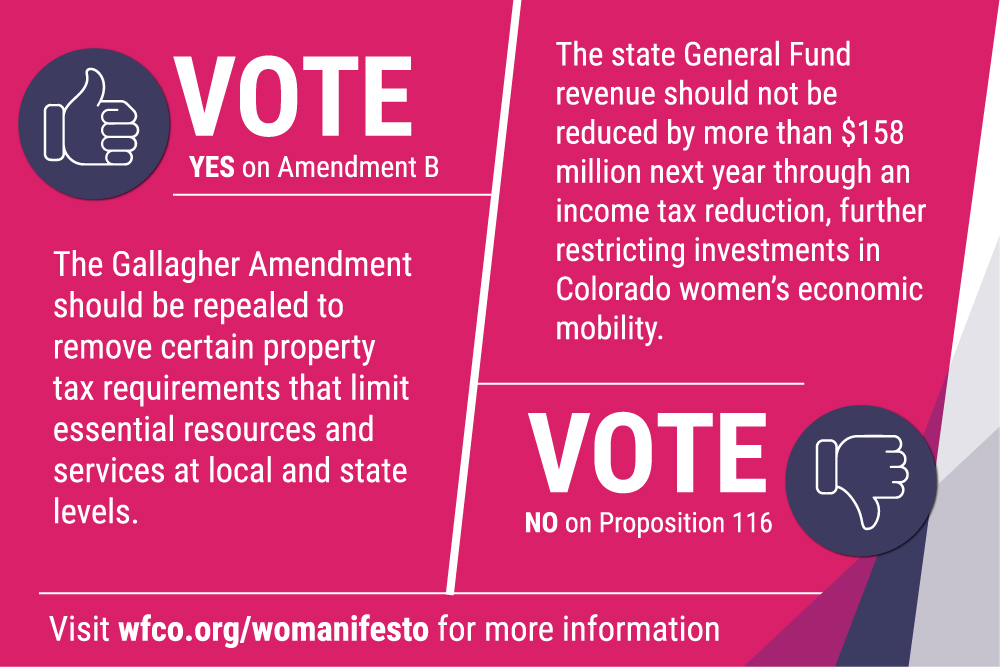

No on Prop. 116, Yes on Amendment B

Guest blog: Public Policy Impacts Our Ability to Put More Coloradans to Work

As president and CEO of the Denver Metro Chamber of Commerce, Kelly Brough is focused on putting more Coloradans to work – in really great jobs. It’s a clear call to action that’s driven this CEO from higher education to City Hall to the Chamber.

Putting more Coloradans in great jobs

The work of the Denver Metro Chamber of Commerce is focused on putting more Coloradans into great jobs. I’ve seen first-hand how a good job changes lives. I won’t ever forget the fear and uncertainty my family felt when my dad was injured and unable to work as a pipeline welder. Nor will I forget the pride and sense of possibility that came as he graduated from college with new skills that landed him a great job.

The work of the Denver Metro Chamber of Commerce is focused on putting more Coloradans into great jobs. I’ve seen first-hand how a good job changes lives. I won’t ever forget the fear and uncertainty my family felt when my dad was injured and unable to work as a pipeline welder. Nor will I forget the pride and sense of possibility that came as he graduated from college with new skills that landed him a great job.

That’s why everything we do at the Chamber is about ensuring we have a strong and sustainable economy with opportunities that can be accessed by everybody. It’s why we work so hard to ensure all three sectors –public, private, and non-profit can thrive and are stable. And, public policy impacts this work. While it may not be the first thing you think of, the truth is that public policy impacts our ability to put more Coloradans to work. And this is certainly true as you look at many of the issues on this year’s ballot.

This year, there are several ballot issues that impact our public sector and will affect their ability to do the work we depend on them to do well.

No on 116: Maintain the current tax rate and invest those dollars in issues that impact all of us

The Denver Metro Chamber opposes Proposition 116, which would reduce our income tax rate in Colorado from 4.63% to 4.55%. While at first glance reducing the tax rate might sound like a great idea, the reality is that our state isn’t funding critical issues today and a reduction in revenue will only ensure our transportation system continues to be significantly under-funded.

Further, our state’s income tax rate has not been a hurdle when attracting companies or executives who want to bring new jobs to Colorado. A greater concern is our failure to invest in our infrastructure and our future. When we can’t move people or goods or maintain access to recreational opportunities in our mountains, it impacts our economic success. Rather than reduce our state’s budget by another $150 million a year, we believe we need to maintain the current tax rate and invest those dollars in these issues that impact all of us. That’s why we believe it’s important to vote no on 116.

We absolutely understand the challenge of managing budgets. Business owners do this work every day and balancing budgets in the past six months has been harder for all of us. Property taxes is one area where there has been a significant increase in costs for business. In fact, businesses have experienced an almost 300% increase in the shift of the property tax burden from homeowners to business owners due to the Gallagher Amendment. Amendment B would repeal Gallagher and we’re supportive of doing so.

Yes on Amendment B: The Gallagher Amendment is hurting our local communities and employers

The Gallagher Amendment requires 45% of the total share of state property taxes come from residential property taxes and 55% come from non-residential (commercial) property taxes. When home values rise rapidly or many more homes are built, this amendment in our Constitution triggers a cut to the residential assessment rate, a key part of the formula that determines the property taxes due.

While that may sound like music to your ears, the truth is this amendment is hurting our local communities and employers, which impacts us all.

Since its passage, the residential assessment rate has dropped to 7.15% from 21%, which has decreased revenue for many local communities, especially in rural Colorado. For many school districts, this shift means there is less local funding to support them. Further, the state is required to make up those funding short falls for our K-12 system but it hasn’t been able to make those local communities whole.

And, with a significant percentage of our state budget now going to K-12 education we have less resources to fund what state budgets typically are used for — transportation and higher education. For businesses, Gallagher has meant higher taxes as businesses now pay more than four times the property tax rate that homeowners do because of the shifting tax burden. We know this formula isn’t sustainable and the pandemic has only made that clearer to all of us.

Those increases cannot be sustained by businesses, especially in rural Colorado, and the inability of local communities to fund their schools and public safety programs negatively impacts each and every one of us.

An important lesson for all of us is that formulas in our Constitution don’t work. Even if the formula might have made sense when it was put in the Constitution, we can guarantee it won’t make work 30 years later. And, that is exactly what’s happening today. Repealing the Gallagher Amendment simply means that 7.15% assessed rate for homeowners is locked in and any increase would still require a vote – because that constitutional provision isn’t impacted by this change.

We hope you join us in voting no on 116 and voting yes for Amendment B.

To learn more about WFCO’s positions, no on 116 and yes on Amendment B, check out our ballot guide, The Womanifesto.

The Women’s Foundation of Colorado is a nonpartisan organization. The opinions of guest bloggers are their own and do not necessarily reflect the opinions or positions of The Foundation.