2024 Legislative Session Highlights

Colorado Women Will Have More Cash in Hand & Protections to Be Their Authentic Selves

The policies passed in the 2024 legislative session will significantly impact the lives of Colorado women and their families. Colorado women will have more money in their pockets through bills increasing access to tax credits, early childhood education, maternal health, and period products. They will also have more protections to be their authentic selves without fear of discrimination through the expanded CROWN Act, which added hair length, and two bills that protect the rights of trans people.

2024 legislative session by the numbers

Numbers to note 2024 legislative session include:

- 705 bills were introduced this session – 472 in the House and 233 in the Senate

- The Women’s Foundation of Colorado took positions on 29 bills

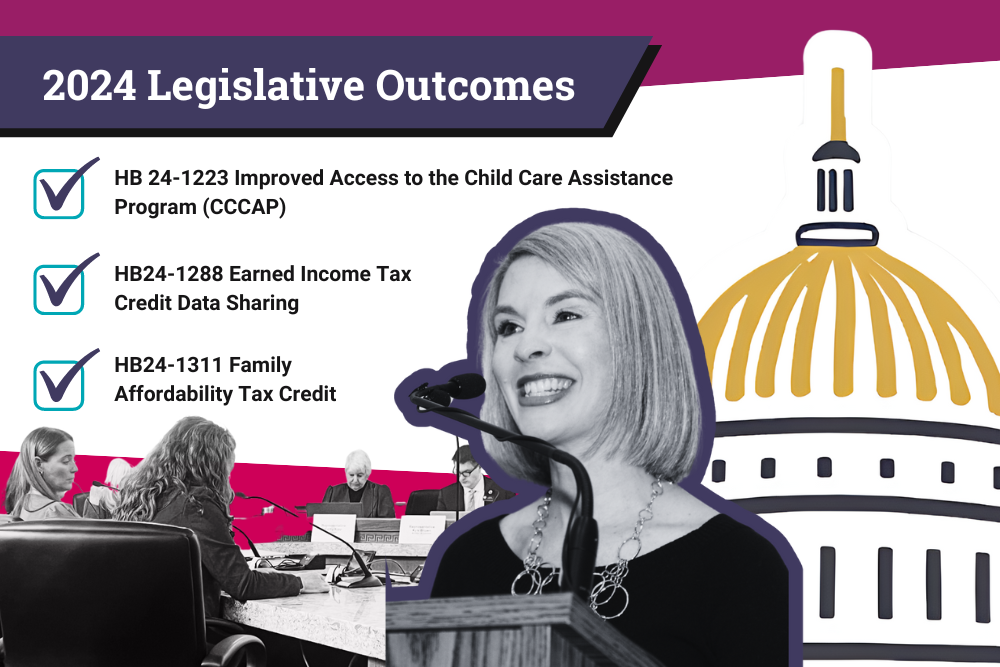

- The Women’s Foundation of Colorado’s three priority bills all passed

- One of our priority bills, the Family Affordability Tax Credit, creates a refundable tax credit of up to $3,200 for families making $95,000 per year or less.

- More than 40 individuals attended our first in-Capitol Advocacy Day since 2020.

- Coming in at 3rd in the nation, 49% of Colorado’s legislators identify as women. As they say, representation matters!

Our three priority bills will significantly impact families’ financial futures

Excitedly, all three of the bills we lobbied for passed. As of the publication of this post, most are still waiting to be signed into law by Gov. Polis. We are grateful for the legislative champions, coalition leads, and individuals who worked tirelessly to ensure that these bills passed the legislature. WFCO supported these bills by working with our lobbying partner, Frontline Public Affairs, and public policy committee; actively participating in coalitions; testifying on behalf of bills; giving media interviews; and encouraging our statewide network of advocates to take action.

- HB 24-1223 Improved Access to the Child Care Assistance Program (CCCAP) – This program, also known as CCCAP, provides funds for families who earn low incomes to attend early care and education programs. It is a vital part of the child care structure in Colorado. This bill will simplify the application process for families and providers; implement accessibility practices, including expanded eligibility for parents in substance abuse disorder treatment; create a pilot program of provider-initiated process for CCCAP qualified exempt status, and a study delinking Child and Adult Care Food Program from CCCAP.

- HB24-1288 Earned Income Tax Credit Data Sharing – The Earned Income Tax Credit (EITC) is one of the most effective poverty reducing tools that we have in our country. Unfortunately, the usage of the EITC in Colorado is lower than most states. This bill will create a pilot program with the goal of increasing usage of the EITC by increasing coordination between state agencies.

- HB24-1311 Family Affordability Tax Credit – This bill will create the Family Affordability Tax Credit, which is an extension of the Child Tax Credit (CTC). Like the EITC, the CTC is an extremely effective way to lower childhood poverty. Remarkably, this bill, combined with other state tax credits, will cut childhood poverty in half in Colorado when it is implemented next year.

From careworkers to the CROWN Act, WFCO supported 29 total bills advancing gender, racial, and economic equity

WFCO took positions on 29 bills. The list below includes a few highlights, but be sure to check out the tracker to see them all.

- Bills addressing the root causes of poverty and providing holistic and flexible resources to women and their families, which includes improving the early care and education sector:

- HB 24-1312 State Income Tax Credit for Careworkers – The bill creates a tax credit for a person working in the care workforce in the amount of $1,200 who make up to $100,000 per year.

- HB 24-1164 Free Menstrual Products to Students – Will require all middle and high school female and gender-neutral restrooms to have period dispensers in 100% of the school restrooms by June 2028.

- HB 24-1009 Bilingual Child Care Licensing Resources – The bill requires the Colorado Department of Early Childhood to provide education and information in plain language and other languages to help individuals complete the paperwork required to meet child care licensing compliance requirements.

- Joy Is our Birthright: HB 24-1262 Maternal Health Midwives – This bill expands protections and requires research to improve maternal health and access to midwives in Colorado.

- Bills reforming Colorado’s tax and budget policies to promote equity and allow for sufficient resources to be dedicated to WFCO priorities:

- HB 24-1084 Repeal & Reenact Earned Income Tax Credit (EITC) Increase – This bill expands the state EITC to 50% of the federal EITC for the 2024 tax year, 35% for the 2025 tax year, and 25% for the 2026 tax year and beyond, with the option of a “boost” of up to 50% depending on revenue growth.

- Bills promoting issues and protect rights that promote gender, racial, and economic equity:

- HB 24-1451 Include Hair Length in CROWN Act – The bill adds hair length to the list of traits associated with one’s race that cannot be discriminated against, as enacted in the 2020 CROWN Act.

- HB 24-1039 Non-Legal Name Changes – Requires public schools and institute charter schools to use a student’s preferred name, if a preferred name is requested by the student; and deems a school’s refusal to use a student’s preferred name a form of discrimination.

- HB 24-1071 Name Change to Conform with Gender Identity – The bill authorizes the court to require a petitioner to give public notice of a name change if the name change was requested by a petitioner with a felony conviction and is for the purpose of changing the petitioner’s name to conform with the petitioner’s gender identity.

- SB 24-053 Racial Equity Study – The bill requires establishes the Black Coloradan racial equity commission to conduct a study to determine historical and ongoing effects of slavery and subsequent systemic racism on Black Coloradans that may be attributed to Colorado state practices, systems, and policies, and to identify measures to address those effects.

Two bills did not pass, but will stay on our radars for future sessions

Unfortunately, there were two bills WFCO supported that did not pass. We believe that both of these bills are vital policies to improve the lives of women in our state and we thank the legislative champions, coalition leads, and individuals who are committed to these policies. WFCO looks forward to continuing to support them in the future.

- HB 24-1297 Baby Bonds Program Study – The bill directs the state treasurer to conduct a study to evaluate the feasibility of and to make recommendations regarding the creation of a “baby bonds” program, through which the state deposits a specified amount of money into a public trust account and the money is invested by the state treasurer for an eligible child, who may use the money and its earnings for certain eligible uses upon turning 18 years of age.

- SB 24-012 Reentry Workforce Development Cash Assistance Pilot Program – The bill creates the reentry workforce development cash assistance pilot program in the department of corrections to provide cash assistance to persons who enroll and participate in workforce services or training programs after incarceration.

Looking toward “Ballots and Bubbles” this fall

Gov. Polis has until June 7 to sign the bills that passed the legislature. If you’re wondering how you can keep the successful legislative session momentum alive, WFCO will be bringing back our popular ballot guide The Womanifesto this fall, along with an event-in-a-box toolkit, called Ballots and Bubbles, to help you get your networks to vote. WFCO also took two support positions on bills that referred measures to the ballot:

- HB24-1349 Firearms & Ammunition Excise Tax – Colorado voters will have the opportunity to impose a 6.5% excise tax on firearms and ammunition. The revenue will support crime victims, including survivors of domestic violence and abuse, school, and behavioral health programs.

- SCR24-003 Protecting the Freedom to Marry – Colorado voters will be asked to amend the state’s constitution to remove its current ban on same-sex marriage. While same-sex marriage is legal in Colorado, the constitution defines marriage as between a man and woman.

Come to our in-person celebrations in May and June

Register for our Advocating4Impact events in Denver and Northern Colorado to celebrate the end of the session below.

DENVER Advocating4Impact: End of Session Celebration

Thursday, May 30 | 5-6:30 pm

Colorado Health Capitol 4th Floor | 303 E 17th St. Denver, CO 80203

NORTHERN COLORADO Advocating4Impact: End of Session Gathering

Wednesday, June 5 | 4:30-6:30 pm

The home of WFCO Trustee Courtney Lussenhop

Public Policy and Advocacy is a Team Sport

WFCO could not do this work without our tireless legislative champions, nonprofit partners, WFCO public policy committee members, and our contract lobbying partner at Frontline Public Affairs. And of course YOU! Please join us at our upcoming events and stay connected as we get closer to the election.